Here's what BHP looks like today:

As you can see, it had been consolidating for about two weeks around $45 and was due for a breakout which happened yesterday. As it broke downward, today I get an opportunity to write something with a decent premium against it and a good strike price too. I decided to write a put at a $43.50 strike with an August expiry - the price was $43.10 at the time, so this was already in the money. The reason for writing more aggressively this month is that I'll be quite happy if I get exercised.

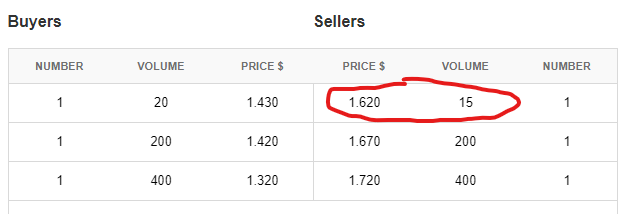

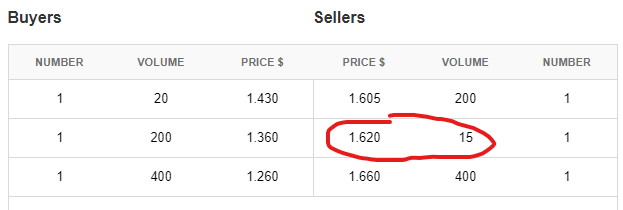

I took some screenshots to show what was going on at the time:

You can see my offer quite easily as I'm the one selling 15 contracts Right after the first pic, BHP rallied so the value of the put started dropping, as you can see by the second pic. Notice that one guy looking to buy 20 contracts? Yeah I should have sold to him, but I was holding out at $1.62. He upped his bid to $1.50, then $1.53 and was accepted right away. You can see that here:

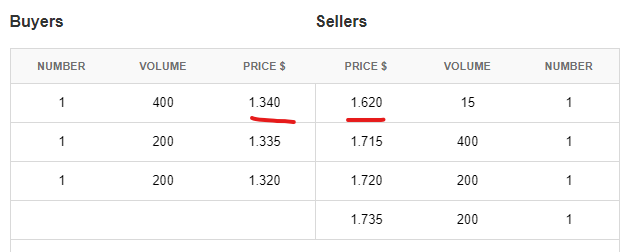

I'm left in the market with nobody wanting to accept my offer of 1.62.... so I drop my price a bit.

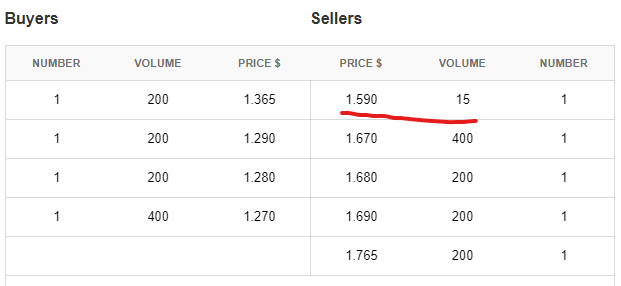

I'll wait until 3 pm to decide what I want to do next. It's 1 pm now and BHP has rallied to $43.40.

In the end, I decided I wanted to open the position, so I dropped the price to $1.43 and it filled in a few minutes. It's $240 less to me than if I filled it at $1.59, but I did just receive a sweet premium of $2145 (15 contracts x 100 @ $1.43). Had I accepted the bid earlier in the day, I would have got an extra $150, but I'm not too unhappy about it all things considered. In 42 days it will expire and I'll either own some BHP purchased at $43.50, or not. I keep the $2145 either way.

Comments